Top 5 Reasons Why Crypto Market is Down Today Explained and What Next

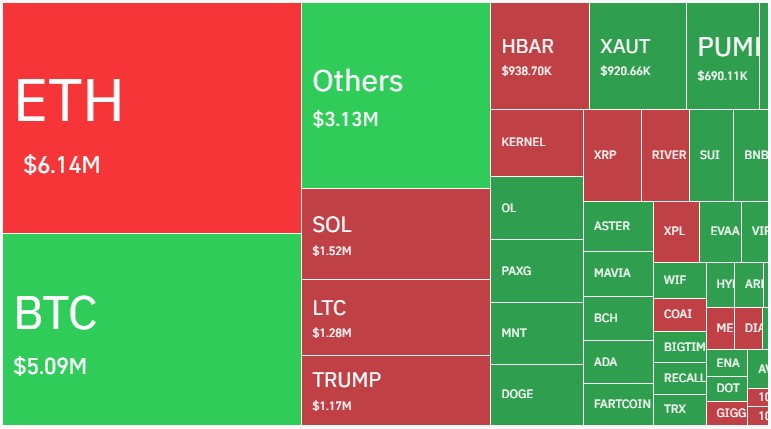

Is the market losing its momentum again? After weeks of bullish optimism, global cryptocurrency capitalization slipped by 0.4% to $3.96 trillion, raising one big question — Why is the Crypto Market Down Today? The leading cryptocurrency, Bitcoin, dropped over 1% in a day, now trading around $114,246.61, with a $2.28 trillion market cap and $50.58 billion in daily volume.

Source: CoinMarketCap

One of the biggest losers was Pi Coin, which crashed 14% in a single day, now at $0.2312 with a $1.91 billion market cap. With Bitcoin and altcoins facing a red day, let’s break down the top reasons behind the current decline and what could happen next.

Why Crypto Market is Down Today? 5 Reasons

CryptoOracle Prediction Comes True

Analyst CryptoOracle recently forecasted a 30–40% correction tied to the U.S. government shutdown. His thesis was simple — liquidity would “break first, then fix later.” As Bitcoin hovered near $110,000, he predicted a slide into a “fear range” between $65,000 and $75,000, before a rebound toward $250,000 in the next two years. The current price movement and fear index align precisely with his analysis, reinforcing how psychology and liquidity still dominate cycles.

x402 Protocol Hack Sends Shockwaves Across the Market

A major reason why the Crypto Market is down today is the x402 Protocol hack, which hit Coinbase’s cross-chain bridge. According to GoPlus Security, hackers targeted over 200 users, draining 17,693 USDC. The incident followed a 500% surge in the bridge’s token value — a classic setup for exploiters.

The hacker gained control of address 0x2b8F and used the transferUserToken method to drain funds, later swapping them for ETH and moving assets to Arbitrum. Security firms have urged users to revoke wallet authorizations linked to x402 immediately. This exploit reminded investors of how fragile DeFi protocols can be.

The US Government Shutdown Shakes Investor Confidence

Another crucial reason behind today’s dip is the US government shutdown, which has now lasted 28 days — the second-longest in history. The political standoff between Democrats and Republicans has triggered deep uncertainty in the global financial sector.

Investors are shying away from risky assets like crypto, fearing liquidity crunches and regulatory delays. This shutdown directly impacts sentiment and trading volume — two pillars of the crypto ecosystem.

Liquidation Heatmap: Massive Sell-offs Continue

Within the last 24 hours, over 118,110 traders were liquidated, totaling $279.82 million in forced sales. The largest liquidation occurred on Hyperliquid (BTC-USD), worth $6.31 million.  Source: CoinGlass

Source: CoinGlass

Such large-scale liquidations accelerate downturns, as leveraged positions trigger cascading sell orders. It’s a textbook example of how fear spreads quickly in volatile markets.

Fear and Greed Index

The Crypto Fear & Greed Index now reads Neutral (50) — down from 51 yesterday, but higher than 34 last week. This index indicates that the industry has cooled from fear but hasn’t regained full confidence yet. Historically, such neutral phases often precede sharp moves — either recovery or deeper correction.

What’s Next? Fed Rate Meeting Could Change the Game

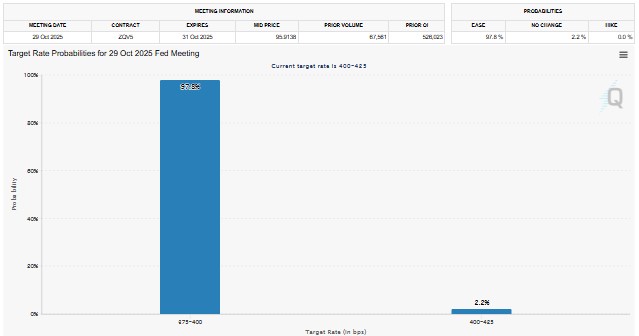

The Fed interest rate decision today might bring a silver lining. The October 29 Fed meeting is expected to deliver another rate cut, with a 97.8% probability of a 50bps reduction and only a 2.2% chance of a smaller 25bps cut.  Source: FedWatch Tool

Source: FedWatch Tool

If confirmed, this move would lower borrowing costs and encourage fresh investment into risk assets like Bitcoin and crypto, potentially reversing the market’s current decline. Additionally, market attention is also centered on Fed Chair Powell’s press conference and the meeting between President Trump and President Xi on Thursday.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.