Fresh Wallet Activity: 300 BTC Withdrawal from Binance Sparks Speculation

Key Takeaways:

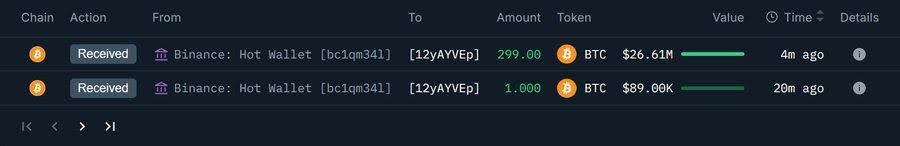

- A newly created wallet has withdrawn 300 BTC worth approximately $26.7 million from Binance, signaling fresh accumulation activity.

- The transaction raises speculation about new institutional entrants, OTC deals, or strategic long-term holding behavior.

- Large withdrawals from centralized exchanges often correlate with tightening supply and shifting market sentiment.

A major on-chain movement has caught the attention of analysts recently, as a fresh, previously inactive Bitcoin wallet withdrew 300 BTC from Binance in a single transaction. Valued at about $26.7 million, this transfer has ignited speculation across the cryptocurrency landscape regarding who could be behind the move and what implications it might have for Bitcoin’s liquidity in the near term.

The Significance of 300 BTC

While a singular transfer might not decisively indicate market trends, the significance lies in its size. The withdrawal of 300 BTC from a newly created address suggests intentional accumulation, rather than day-to-day trading activity. As the supply of Bitcoin on exchanges continues to trend downward, such withdrawals further emphasize a narrative: more BTC is being directed towards long-term storage rather than being injected into circulation.

The wallet address in question, 12yAYVEpspHd1JtTxuvQxkfK746c6kqq1c, exhibited no prior activity before this withdrawal. This fact bolsters the theory of a new whale or institutional player entering the market, focused on accumulating assets.

Characteristics of the Withdrawal Raise Key Questions

This unexpected withdrawal leads to several intriguing questions:

-

Why use a newly created wallet?

Long-term cold storage or strategic reshuffling often entails the use of fresh wallets. This approach can provide enhanced security and privacy for large holders looking to shield their assets. -

Why withdraw directly from Binance?

Large-scale withdrawals from centralized exchanges typically align with the goals of holders seeking to mitigate counterparty risk and move assets offline. This action minimizes exposure to digital asset exchanges, which can be vulnerable to hacks or insolvency issues. - Does the timing connect with wider market behaviors?

Historically, significant withdrawals have coincided with spikes in institutional interest, crypto ETF flows, and periods of macroeconomic uncertainty. Observers will be keen to see whether this movement aligns with broader trends in the industry.

The nature of this transaction indicates deliberate intent rather than mere rebalancing or arbitrage trading. Such flows cause on-chain analysts to pay closer attention, as they may imply that new capital is being established in longer-term positions.

Exchange Outflows Continue as Market Liquidity Tightens

The recent exit of 300 BTC is not an isolated event; it forms part of a larger trend. The total value of Bitcoin held across major centralized exchanges has been dropping consistently throughout the year. This decline is noteworthy, as diminished exchange reserves may lead to reduced supply in circulation, complicating sellers’ abilities to push prices downward against strong buyer demand.

Declining Exchange Balances Strengthen the Bullish Supply Narrative

The ongoing trend in outflows reflects several key factors:

- Long-term holders absorbing supply: Many seasoned investors are continuing their accumulation, further entrenching their positions.

- Cold storage preferences: More Bitcoin is being transitioned to wallets deemed secure and associated with long-term storage.

- Rising institutional interest: Following clearer regulatory frameworks in major markets, institutions are showing increased interest in Bitcoin.

- Preference for self-custody: High-net-worth individuals tend to signal that they prefer storing their BTC in self-custody over exchanges.

It’s essential to note that while attributing any single sale to a determined buyer remains elusive without additional context, the scale of such withdrawals strongly suggests participation from whales or institutional entities rather than retail traders.

The Market’s Response to Accumulation Trends

Given the ongoing dynamics within the crypto market, analysts will closely monitor further developments. The rapid emergence of such significant withdrawals hints at a potential shift in market sentiment, with increasing accumulation serving as a critical marker of institutional confidence. As the landscape evolves, understanding these movements will be essential for grasping the broader implications for Bitcoin’s future.

The recent withdrawal from Binance serves as a striking reminder of the shifting tides in cryptocurrency, where accumulation patterns can influence broader market narratives. As fresh players enter the fray, the implications for Bitcoin’s liquidity, price action, and long-term trajectory carry weighty significance for both traders and investors alike.