In the current climate of a bullish crypto wave, traders and investors must prepare for potential volatility as Bitcoin (BTC) and Ethereum (ETH) options contracts near expiration.

Historically, markets tend to stabilize shortly after options expire, allowing traders to recalibrate for the new trading environment.

What Traders Should Expect from Today’s Expiring Options

The ongoing bullish trend in the crypto markets has set the stage for a significant options expiry today, with far-reaching implications for trading behavior leading into the weekend.

Specifically, more than $5.76 billion in notional value tied to Bitcoin and Ethereum options is scheduled to expire this Friday, representing a considerable amount of market activity.

Data from derivatives exchange Deribit indicates that Bitcoin currently has an open interest of 40,945 contracts, amounting to a notional value of $4.91 billion. The max pain point—the price at which the greatest number of options expire worthless—sits at an astonishing $114,000, well below the current spot price of BTC trading at $120,259.

Furthermore, the put-to-call ratio is at an encouraging 0.78, suggesting that traders are leaning bullish, favoring call options that profit from price increases.

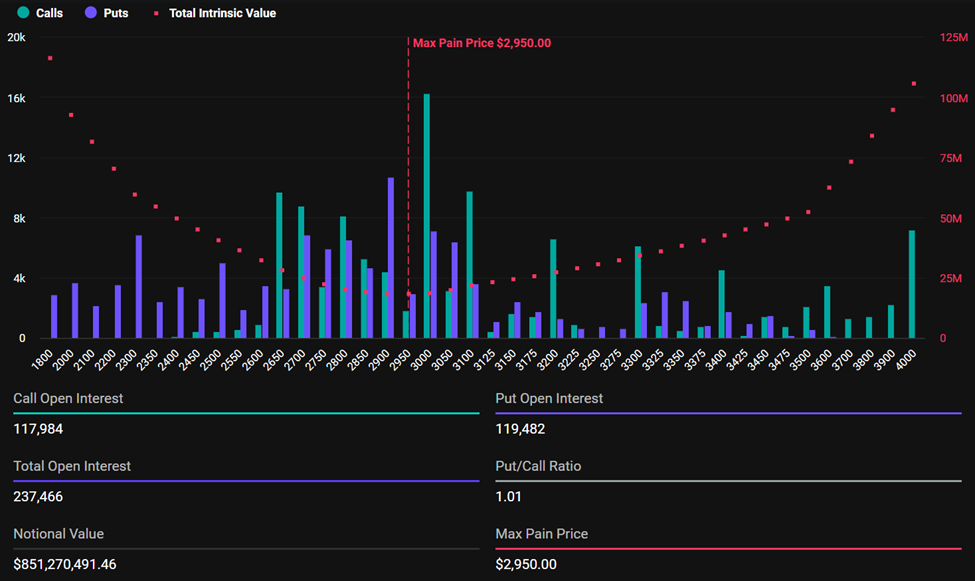

On the Ethereum side, the options market presents a more neutral outlook, with 237,466 contracts in open interest valued at approximately $851 million. The put-to-call ratio stands at 1.01, indicating a balanced sentiment of bullish and bearish positions, while the max pain level is set at $2,950, which is also significantly lower than ETH’s current range.

Interestingly, this week’s expiring options reflect a slight increase compared to the previous week. As previously reported by BeInCrypto, on July 11, 36,970 BTC contracts with a notional value of $4.31 billion expired, alongside 239,926 Ethereum contracts worth $712 million.

Cautious Optimism Ahead of Options Expiry

Analysts from Greeks.live describe the current sentiment as mixed, with some traders speculating that the recent price rallies may indicate a peak, while others maintain expectations for higher valuations later in the year.

“…expecting 150,000 BTC by Q4 but anticipating a correction until September,” the firm noted.

In the immediate term, many traders are employing risk reversal strategies, a common approach in options markets. This strategy typically involves selling 30-day puts while purchasing 30-day calls, reflecting a bullish outlook alongside protective measures against unforeseen losses.

This approach indicates that while some market participants anticipate upward momentum, they are also hedging against abrupt downward shifts.

As the market braces for volatility, current positioning shows diverging attitudes toward Bitcoin and Ethereum. Volatility remains a pivotal aspect of market discussion; Ethereum’s implied volatility, for instance, remains around 70% after a significant price spike, presenting opportunities for basis trading and volatility squeeze strategies.

According to insights from Greeks.live, traders are proactively managing their risk exposure ahead of today’s options expiry, bracing for potential turbulence. The combination of substantial notional values, skewed max pain points, and varying sentiment sets the stage for what could be significant volatility.

With both Bitcoin and Ethereum trading above their respective max pain points, a price pullback is plausible as these options approach expiration. However, traders may begin to see market stabilization afterward as they adjust to the new trading conditions.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.