The cryptocurrency market has rebounded slightly this week following President Trump’s Monday announcement of the Israel-Iran ceasefire.

In the aftermath, several cryptocurrency assets have exhibited varying degrees of rallying performances. While some have surged significantly, others have struggled to gain momentum, leading to a state of mixed recovery. Notably, on-chain data indicates that crypto whales are actively accumulating specific altcoins, notably Uniswap (UNI), Worldcoin (WLD), and SAND.

Uniswap (UNI)

This week, Uniswap’s decentralized finance (DeFi) token, UNI, has captured significant attention from whales. A noteworthy increase in the netflow of large holders—defined as those holding more than 0.1% of UNI’s circulating supply—has been reported, showing a remarkable 190% rise over the past week, according to IntoTheBlock.

Large holders have played a pivotal role in the token’s recent performance. The netflow metric measures the balance between the amount of tokens that these holders are buying and selling over a specific timeframe. An uptick in this metric generally suggests a bullish sentiment, indicating strong accumulation and confidence in the asset’s future.

This recent accumulation trend could ignite interest among retail traders, leading to increased buying pressure for UNI. If the enthusiasm persists, it may propel UNI into the coveted $7 price zone. Conversely, a decline in demand could see the token’s price retracing to around $5.91, creating an essential trading pivot for market participants.

Worldcoin (WLD)

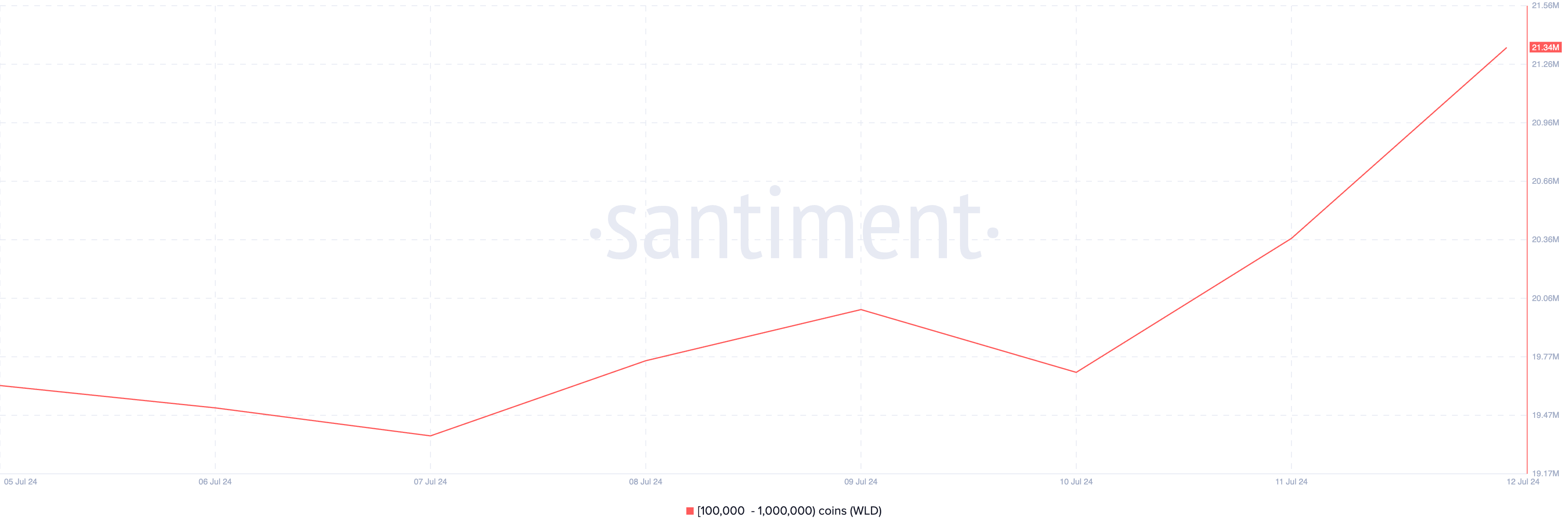

Another altcoin attracting whale attention this week is Worldcoin (WLD), notably with its backing from tech leader Sam Altman. According to data from Santiment, there’s been a substantial increase in the holdings of wallets containing between 100,000 and 1 million WLD tokens. This cohort of whale participants acquired a staggering 1.72 million tokens, amounting to over $3 million in value.

This surge in whale demand not only enhances WLD’s market profile but also positions it for potential price movements. If bullish sentiment continues, WLD could break through its resistance level of $0.97 soon. However, should the market sentiment turn bearish and selling pressure increase, we might see WLD depreciate to approximately $0.57, marking a critical support level for traders to monitor.

The Sandbox (SAND)

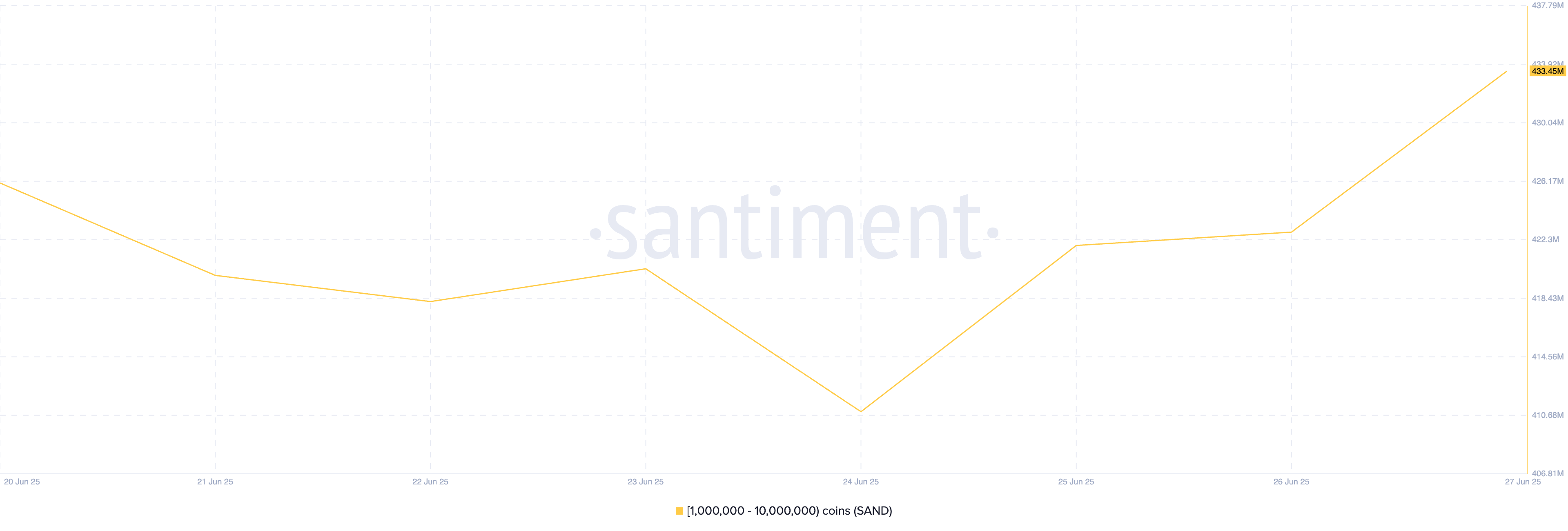

Lastly, the metaverse-based token SAND has exhibited a significant rise in whale activities recently. Santiment’s data reveals that large investors holding between 1 million and 10 million SAND tokens have amassed an impressive 7.45 million units over the past week, indicating a solid uptick in market confidence among major stakeholders.

This notable accumulation trend suggests that investors are growing increasingly bullish about SAND’s long-term value. Should retail traders follow this bullish sentiment, SAND’s price could journey toward the $0.30 mark in the upcoming weeks. However, a decline in buying activity might lead to a price pullback to around $0.21, presenting another pivotal zone for traders to keep an eye on.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.