### Binance to Delist 14 Tokens: A Shift in the Crypto Landscape

Binance, the giant of cryptocurrency exchanges, is set to delist 14 tokens on April 16, following a decisive vote and their standard delisting procedures. This announcement marks a significant moment in the continuously evolving crypto market. Among the tokens facing removal are TROY, SNT, and UniLend (UFT), with users advised to prepare for the impact this change will bring.

### The Token Selection Process

Binance employs a rigorous evaluation framework to determine which tokens will be delisted. This includes several important metrics such as vote outcomes from the community, the commitment of the project teams, development activity, and trading volume. Binance also monitors the safety of the networks behind these tokens, community involvement, and the teams’ responsiveness to inquiries.

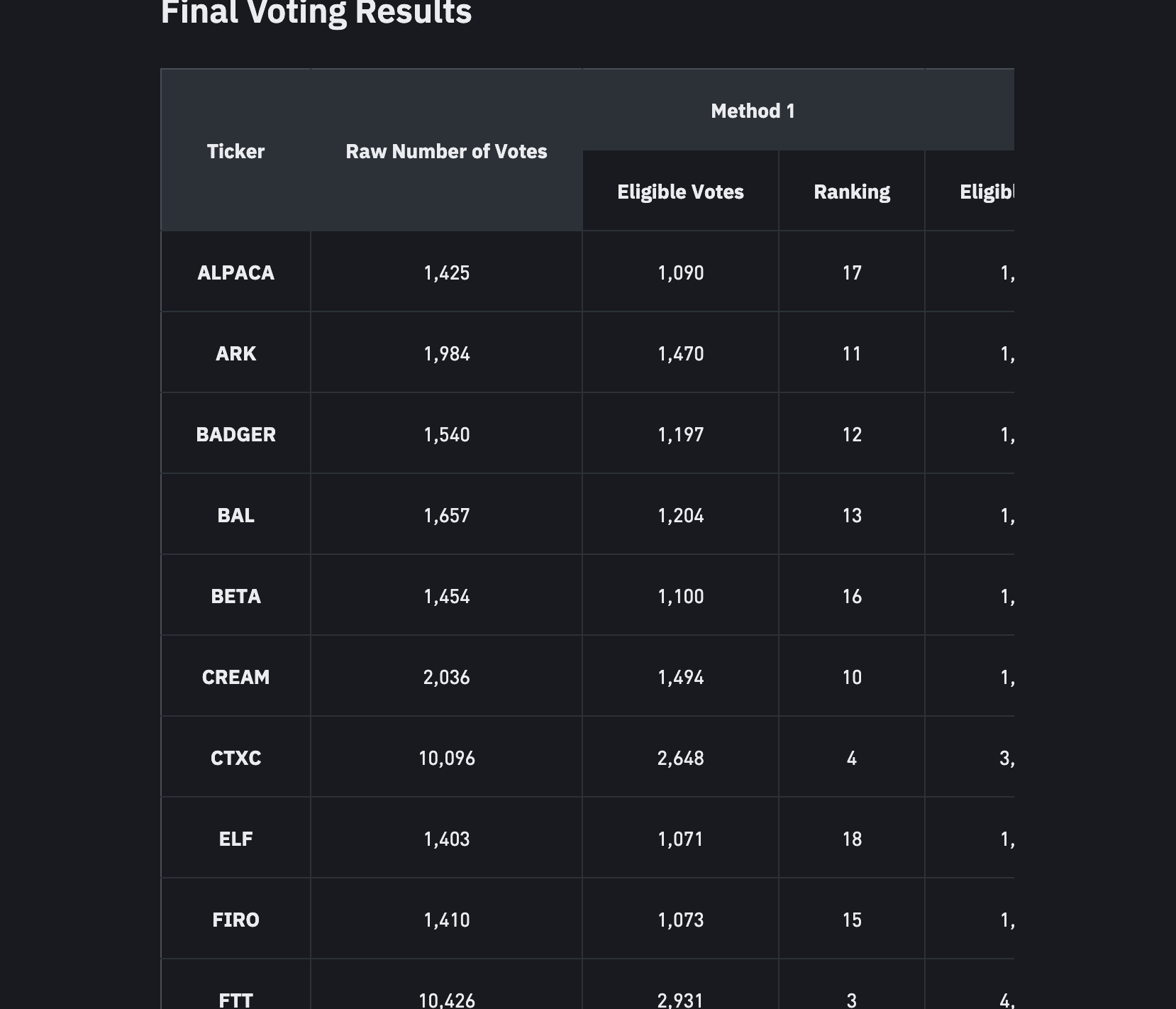

Another layer of scrutiny arises from the ever-changing regulatory landscape and whether token supply changes appear justified. Data integrity is crucial, as Binance also filters out votes potentially influenced by fraudulent activities or coordinated efforts through IP filtering. Out of a total of 103,942 votes cast, only 93,680 were deemed eligible.

### Tokens Under the Spotlight

The tokens set for delisting include:

– BADGER

– Balancer (BAL)

– Beta Finance (BETA)

– Cream Finance (CREAM)

– Cortex (CTXC)

– Aaelf (ELF)

– FIRO

– Kava Lend (HARD)

– NULS

– Prosper (PROS)

– SNT

– TROY

– UniLend (UFT)

– VIDT DAO (VIDT)

Users should take note that trading for these tokens will cease on April 16, and all open orders will be automatically removed. Additionally, Binance has recommended that users adjust their trading bots accordingly to prevent unexpected losses.

### What This Means for Users

The delisting will directly impact several Binance services, including futures trading, margin trading, loan services, and the Simple Earn program. Notably, positions in Binance Futures for these tokens will be closed, with automatic settlement occurring on April 14 at 09:00 UTC.

Moreover, account information related to the delisted tokens will be phased out. Users should ensure they uncheck the “Hide Small Balances” option on their accounts to view any remaining assets related to these tokens. Post-April 16, deposits will not be credited, and support for withdrawals will also be terminated.

### Recovery of the Crypto Market

In a parallel shift, the cryptocurrency market managed to recover its market capitalization to $2.596 trillion after a tumultuous sell-off over the weekend. This rebound signals a resurgence of investor confidence, particularly for major cryptocurrencies such as Bitcoin, which is currently trading above $79,000.

Despite this uptick, analysts caution that Bitcoin may struggle to surpass the $80,000 threshold in the immediate future, especially with potential reciprocal tariffs looming. Meanwhile, meme coins and decentralized finance (DeFi) tokens have seen notable gains, highlighting the dynamic and often unpredictable nature of the crypto market.

—

This article explores Binance’s upcoming token delisting and its implications for users while providing insights into the current state of the cryptocurrency market. Stay informed and ready for the changes ahead as the landscape continues to develop.