Binance’s Altcoin Trading Surge: A Deep Dive into the Current Landscape

With a staggering 78% dominance in altcoin trading, Binance has solidified its position as the leading cryptocurrency exchange for alternative cryptocurrencies. Analysts have noted this increase as a robust indicator of growing investor interest in altcoins, shifting the focus away from Bitcoin (BTC)—and it appears the trend is only gaining momentum.

The Recent Shift

As per insights from Burakkesmeci, a contributor to CryptoQuant, Binance’s altcoin trading volume has surged 11% since May 2024, when it was at 50.8%. The current figure of over 77% signifies that traders are increasingly gravitating towards altcoins, hinting at a potentially explosive bull market for 2025. "Retail interest in altcoins is steadily rising," Burakkesmeci notes, which could drive substantial momentum in the altcoin market in the coming months.

Chart showcasing major altcoin trade volume dominance on Binance. Source: Burakkesmeci/Cryptoquant

This heightened interest reflects a noteworthy change in the cryptocurrency landscape. Investors are diversifying their portfolios, casting wider nets beyond just Bitcoin and Ethereum (ETH). While Bitcoin remains a focal point, altcoins are becoming increasingly attractive to both retail and institutional investors.

The Role of Ethereum

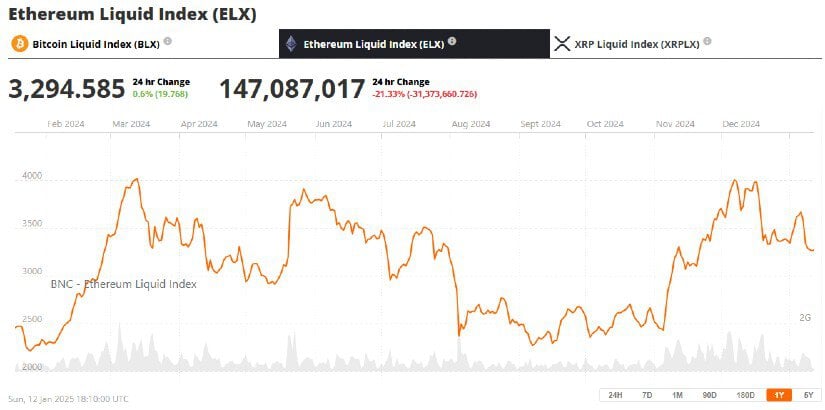

Ethereum, the second-largest cryptocurrency by market cap, has been pivotal in this shift. Traders are closely monitoring ETH’s price movements, with some analysts predicting a significant upside. Mister Crypto, a prominent trader, affirms, "If Ethereum breaks resistance levels, we could see it go from $4,000 to $8,000." Such price action could ignite a broader rally across the altcoin market, as Ethereum has historically been a leader in price dynamics.

Ethereum (ETH) price chart. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Despite a recent dip of nearly 16% in the past month, Ethereum is positioned precariously close to key resistance levels. This situation is fostering a sense of anticipation among traders, who speculate that a breakout could catalyze a sweeping altcoin bull market.

Bitcoin’s Position and Altcoin Season

Even amidst this surge in altcoin dominance, Bitcoin continues to wield considerable influence over the overall cryptocurrency market. The CoinMarketCap’s Altcoin Season Index currently rates at 46, showing a slight inclination towards “Bitcoin Season.” Bitcoin’s overall market dominance stands at 57.74%, having increased by 2.4% in the past month.

The Altcoin Season Index has dropped 18 points since December 9. Source: CoinMarketCap

History tells us that drops in Bitcoin dominance often signal the advent of an altcoin season. As capital flows into altcoins, Bitcoin’s market share typically declines, marking a transition towards alternative cryptocurrencies.

Insights on 2025: A Distinct Era for Altcoins

Looking ahead to 2025, while altcoins are gaining traction, the dynamics may differ from previous market cycles. Ki Young Ju, CEO of CryptoQuant, indicates that this time around, only certain altcoins with strong use cases and narratives are likely to thrive. "This market cycle will differ from those of before because the rotation of capital from Bitcoin into altcoins might not be what drives the market this time around," Ju elaborates.

Along similar lines, Hunter Horsley, CEO of Bitwise Invest, expresses optimism for emerging crypto enthusiasm in 2025. "It’s shaping up to be a breakthrough year for Bitcoin and the broader crypto market," he remarks, emphasizing the shifting tides in investor sentiment and engagement.

The narrative surrounding altcoins is rapidly evolving, and as retail participation continues to rise, the landscape is set for pivotal changes. As we move deeper into this year, the stage is being set for a potential altcoin revolution—this time, more discerning, focused, and perhaps even transformative.