Analyst Predicts Ethereum Rally to End in September

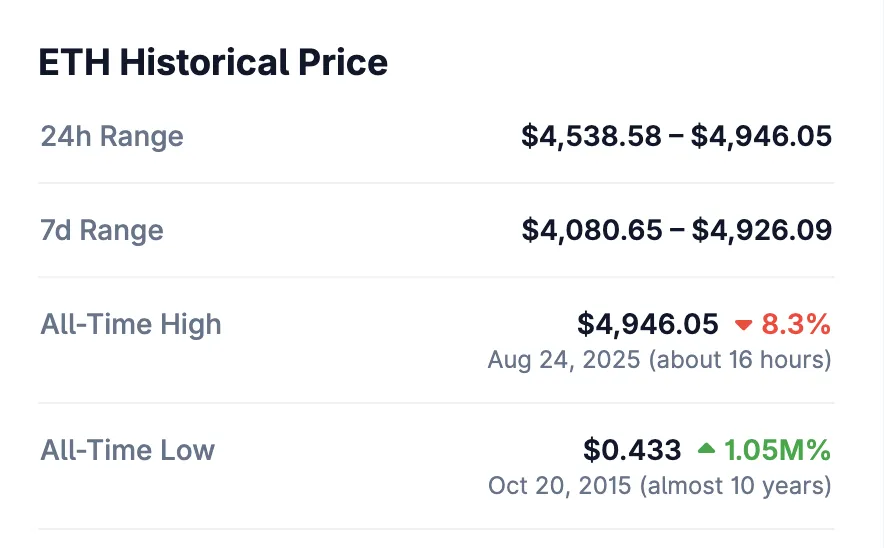

As August draws to a close, the crypto community is buzzing with speculation about what September might hold for Ethereum, particularly following a striking 25% rally that brought the price of the second-largest cryptocurrency by market capitalization to new heights, eclipsing the previous all-time high of $4,867.

Historical Trends: A Cautionary Tale

Historical data presents a somewhat ominous picture for Ethereum investors. According to crypto enthusiast CryptoGoos, the month of September has shown a tendency for corrections in the past—especially during post-halving years. In a recent tweet, he pointed out that "seasonality in September during post-halving years is typically negative."

This historical perspective shouldn’t be ignored: since 2016, Ethereum has recorded gains in September just three times, with each instance followed by declines ranging from 12% to 21%. For example, in August 2017, Ethereum soared by 92%, only to plummet by 21% the following month. A similar trajectory was observed again in 2021, creating a sense of trepidation among traders as September approaches.

The Current Landscape: A Surge Benefiting Ethereums’s Momentum

Despite the looming worry of a correction, the past month has painted a different picture. Ethereum’s 25% rise has captured the attention of traders and investors alike. This time around, there are notable factors at play that could potentially influence Ethereum’s trajectory.

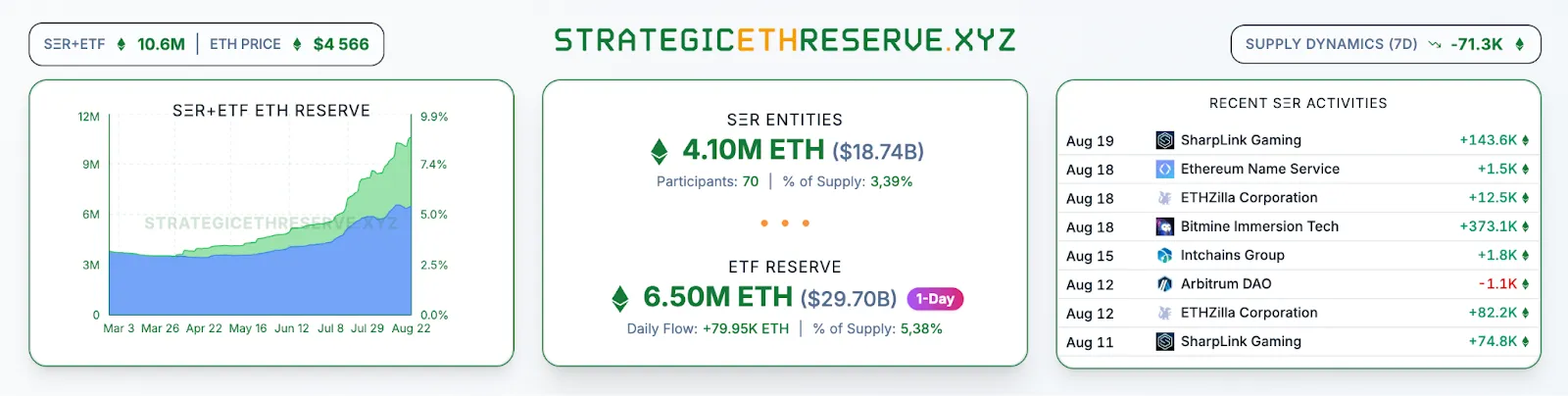

Among them, the influx of institutional investment stands out. Over the last month, spot Ethereum ETFs have attracted a staggering $2.79 billion, creating a buzz in the market. By contrast, Bitcoin-based ETFs recorded outflows of $1.2 billion within the same period, suggesting a shift in focus toward Ethereum and its potential for growth.

The Role of Institutional Players

The year 2025 could indeed be a turning point for Ethereum. Many community members believe that the increasing activity of institutional players may disrupt the historical trend of September declines. For perspective, corporate treasuries have amassed 4.1 million ETH valued at $18.7 billion. Companies like BitMine Immersion Tech are at the forefront, managing over 1.5 million ETH worth approximately $6.9 billion.

This combined ownership of nearly 9% of Ethereum’s total supply signifies a significant bullish sentiment and a strong institutional commitment that could act as a buffer against market volatility.

Changing Sentiments: Whales and Their Influence

Interestingly, while Ethereum has experienced remarkable gains, there’s also been a shift in the behavior of Bitcoin "whales." Reports indicate that some high-net-worth Bitcoin holders have begun selling their Bitcoin to diversify into Ethereum investments. This trend highlights a growing belief in Ethereum’s potential for long-term appreciation.

Factors Supporting Ethereum’s Edge Over Bitcoin

On August 21, analysts from various sectors identified four factors contributing to Ethereum’s recent outperformance when compared to Bitcoin. Aspects like network upgrades, increased adoption for DeFi and NFTs, and expanding institutional interest are creating a multifaceted potential for Ethereum to not just sustain but enhance its recent gains.

Conclusion: A Balancing Act of Caution and Optimism

For Ethereum, the coming weeks will test investors’ resolve as historical trends loom large. While the prospects of a correction in September cannot be overlooked, the factors shaping the current landscape—institutional interest, market behavior among major players, and the potential for disruption—create an intriguing, albeit uncertain, environment.

As always, the cryptocurrency market demands careful navigational skills, sharp insights, and the willingness to adapt to rapidly changing conditions. Ethereum may very well follow its historical pattern, or it could blaze a new trail in this ever-evolving digital landscape.