Created on September 29, 2025

Will Ripple’s recent surge be the catalyst that finally propels XRP’s price into the double-digit zone? As excitement builds around potential regulatory changes, many in the cryptocurrency community are eager to find out.

Spot XRP ETFs Are Coming

Market participants are eagerly awaiting the opening of the altcoin ETF “floodgates” as the US Securities and Exchange Commission (SEC) approaches critical deadlines for spot XRP ETF decisions in October 2025. The landscape has changed dramatically, with over a dozen applications under review from major players such as Franklin Templeton, Bitwise, and Grayscale, all hinting at a regulatory green light.

Recent odds from Polymarket bettors indicate a staggering 99% chance of at least one spot XRP ETF being approved by December 31, 2025, which many see as a near certainty. This sentiment is echoed by popular ETF analyst Nate Geraci, who stated, “The number of crypto ETF filings indicates that the crypto ETF floodgates are set to open soon.”

Bloomberg ETF analysts have also put their estimates for approval odds at 95% or higher, attributing this optimism to the resolution of Ripple’s long-standing SEC lawsuit earlier this year, which has paved the way for institutional adoption.

The momentum was notably enhanced with the launch of the REX-Osprey XRPR ETF on September 18, 2025—the first US-listed fund offering direct spot exposure to XRP. Trading on the Cboe exchange under the ticker XRPR, the product saw a staggering $37.7 million in first-day volume, the highest for any ETF launch in 2025, indicating robust interest from both retail and institutional investors.

As October approaches, starting with VanEck’s filing on October 10, expectations are high. The XRPR’s success could unlock billions in inflows, potentially driving XRP prices to new all-time highs.

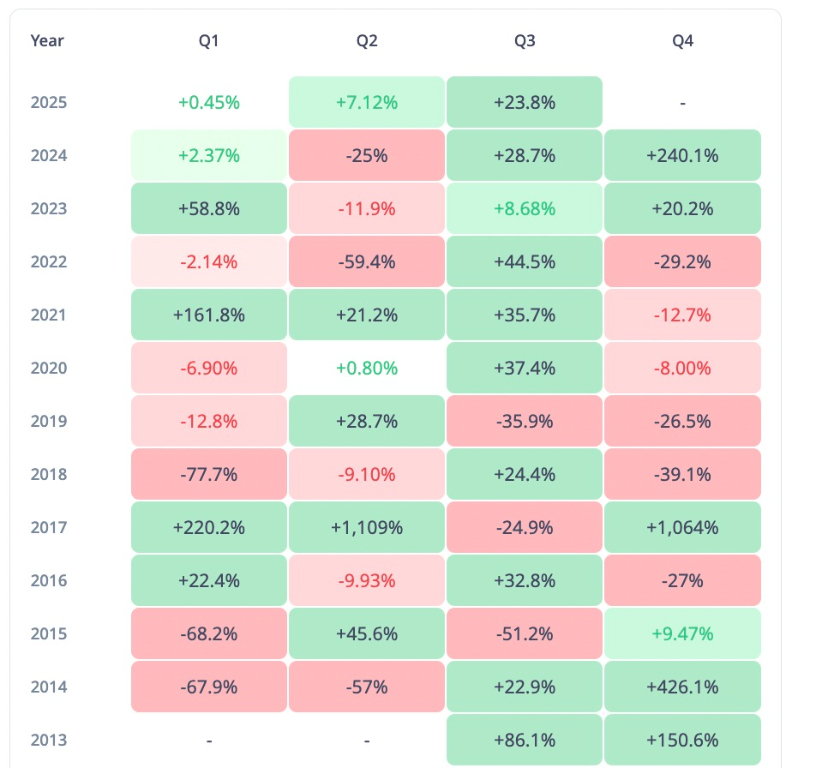

Q4: Historically the Best for XRP Price

Historically, XRP has shown remarkable performance in the fourth quarter. Since 2013, it has consistently delivered positive Q4 returns, averaging over 150% gains during bullish market cycles. One notable year was 2017, when XRP skyrocketed from $0.20 to $2.30 by December, marking a staggering 1,060% Q4 increase fueled by early adoption in cross-border payments and wider crypto enthusiasm.

More recently, XRP enjoyed a 240% rally in Q4 of 2024 and a 20% gain in Q4 of 2023. Year-over-year, Q4 has consistently outperformed other quarters, with an average closing value 200% higher than Q3 lows, based on CryptoRank data.

Considering the historical performance combined with the upcoming ETF catalysts, analysts predict that Q4 2025 could see returns exceeding 300%, potentially pushing XRP prices into the $10-$20 range as institutional FOMO (fear of missing out) meets proven seasonal patterns.

Analysts Target $15-$30 XRP Price

The XRP/USD pair is poised to maintain its bullish momentum as it approaches a classic technical structure suggesting a significant upside. The current price action of XRP has formed a “bull pennant” pattern on the weekly time frame. This pattern indicates consolidation following a robust upward movement, a precursor to further bullish action.

In more precise terms, a bull pennant typically resolves when the price breaks above the upper trendline, often resulting in gains equivalent to the height of the flagpole. For XRP, this breakout occurred at $2.20 in June, aligning with bullish sentiment and suggesting a potential target of $15, translating to a striking 430% increase from current levels.

Currently, XRP’s weekly relative strength index (RSI) is positioned comfortably within the positive range at 54, indicating favorable market conditions for bullish trends in the higher timeframes. Popular XRP analyst XForceGlobal has pointed out that the more XRP consolidates around $2.75, the stronger the eventual breakout could be, with price expectations reaching as high as $20-$30 in October.

Fellow analyst Egrag Crypto has set XRP price targets between $15 and $27, emphasizing the strength of the technical setup. Moving forward, both regulatory momentum and historic Q4 performance may converge to create an unprecedented opportunity for XRP investors.

Ready to trade or dive deeper into Ripple analysis? Check out our list of the best MT4 crypto brokers.