Stripe and Paradigm Launch Tempo: A New Era for Stablecoin Transactions

Stripe and Paradigm have made headlines with their introduction of Tempo, a novel "payments-first" blockchain aimed at enhancing stablecoin transactions. This move has ignited discussions around its potential ramifications on established networks like Ethereum, Solana, and other chains dedicated to payment solutions.

The Concept Behind Tempo

Tempo is designed with a focus on optimizing payments rather than offering the multi-purpose smart contract capabilities seen on platforms like Ethereum. The “payments-first” approach promises to simplify stablecoin access for merchants and Stripe’s extensive user base by reducing the need for complex Layer-2 (L2) solutions or multiple bridge processes. This could mark a significant shift in user adoption, as fintech giants typically lean toward less complicated Layer-1 (L1) solutions.

Comparisons to Libra: A Cautious Optimism

Many industry analysts are drawing parallels between Tempo and the former Libra project, famously initiated by Meta (formerly Facebook). Unlike Libra, which faced substantial backlash and regulatory challenges, Tempo seems to be entering a more favorable political landscape, buoyed by growing institutional acceptance of cryptocurrency.

Ryan Adams from Bankless summarizes this sentiment, stating, “Tempo chain by Stripe is Libra v2 but with a political climate that won’t strangle it in the crib.” However, the real measure of Tempo’s success will be its ability to attract meaningful transaction volumes, lest it become "just another chain."

A Skeptical View: Technical Foundations and Market Reality

Despite the excitement, some experts remain cautious about Tempo’s viability. Critics argue that while the idea of a payments-first blockchain is appealing, its technical foundations may fall short in a market already populated by more robust solutions.

John Wu, the CEO/CTO of Mysten Labs, expresses this skepticism, saying, “There might be business reasons for a Stripe L1, but IMO the cited technical motives are a bit sus in 2025.” Concerns about the platform’s supposed neutrality regarding stablecoins also linger; experts question whether any framework can truly maintain impartiality when vested interests could conflict.

Regulatory Risks and Concerns

The regulatory landscape is another area fraught with uncertainty. The potential for conflicts of interest among stablecoin issuers and issues related to gas tokens on Tempo could undermine trust. “There is a reason why successful L1s only accept their own native token for gas,” remarked one user on X. As the ecosystem evolves, the risk associated with non-native tokens may grow, particularly if Tempo gains traction.

Impact on the Broader Crypto Market

The launch of Tempo dovetails with a broader trend of chain fragmentation, which could actually benefit protocols focused on cross-chain interoperability. As demand for bridges and oracle services like Chainlink (LINK) increases, those providing essential infrastructure may see a substantial uptick in business.

However, some analysts caution against overly optimistic projections for established platforms like Ethereum. Ignas, an industry analyst, points out that while the rise of stablecoins is a generally positive sign, it doesn’t automatically translate into bullish forecasts for ETH.

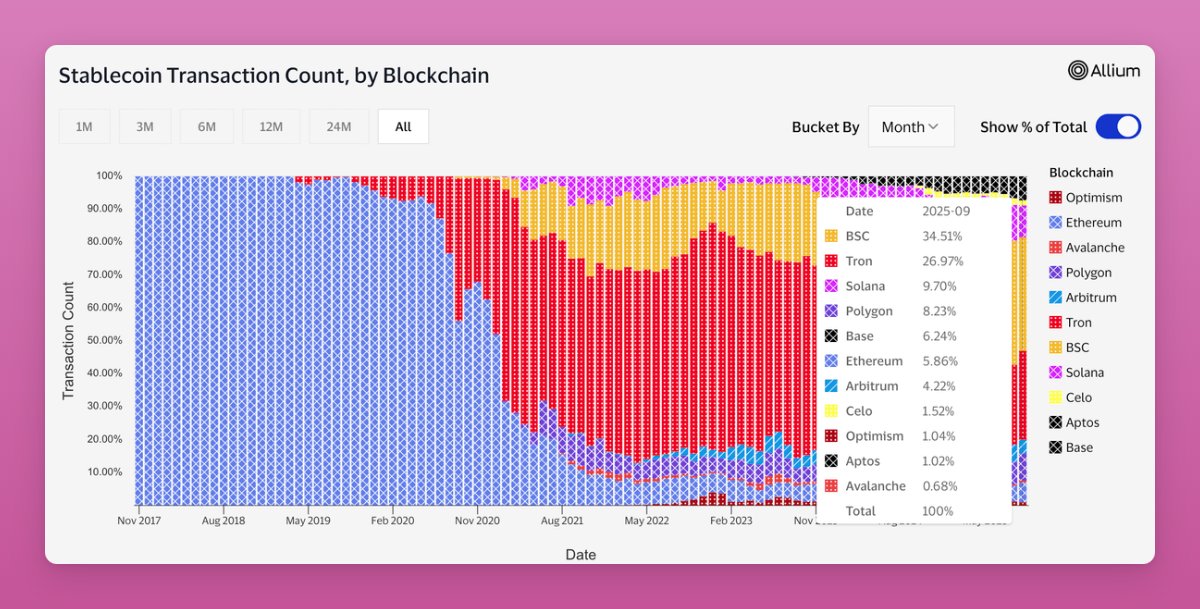

Tempo’s entry could create direct competition for stablecoin transactions occurring on established platforms like Tron, Solana, and Polygon. Despite these competitive pressures, many experts predict that Ethereum could emerge as a significant winner in this evolving landscape.

The Stakes for Established Players

The introduction of Tempo poses a serious challenge to existing players in the payments space. Blockworks CEO Jason Yanowitz suggests that, should Tempo successfully capture liquidity and merchant adoption, it could transform the routing of stablecoin flows significantly.

As this new chapter unfolds, the repercussions for Tether, Circle, and even established blockchains like Ethereum and Solana cannot be ignored. The implications of a successful Tempo could reverberate throughout the entire stablecoin ecosystem, reshaping how transactions are conducted and how value moves across networks.

The launch of Tempo by Stripe and Paradigm places a spotlight on the evolving landscape of stablecoin transactions, setting the stage for debates about its implications for established cryptocurrencies. While the promise of this "payments-first" model sparks interest, the challenges ahead remain significant.